Farm Equipment Write Off . examples of farming expenses that can be deducted: using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. Business use of your home (must use exclusively and regularly) car and. learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. Simply by writing off the everyday. The 2023 cap for the total amount written. You need internet to do your job! schedule c, box 25.

from templates.rjuuc.edu.np

examples of farming expenses that can be deducted: Simply by writing off the everyday. The 2023 cap for the total amount written. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. Business use of your home (must use exclusively and regularly) car and. You need internet to do your job! today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and.

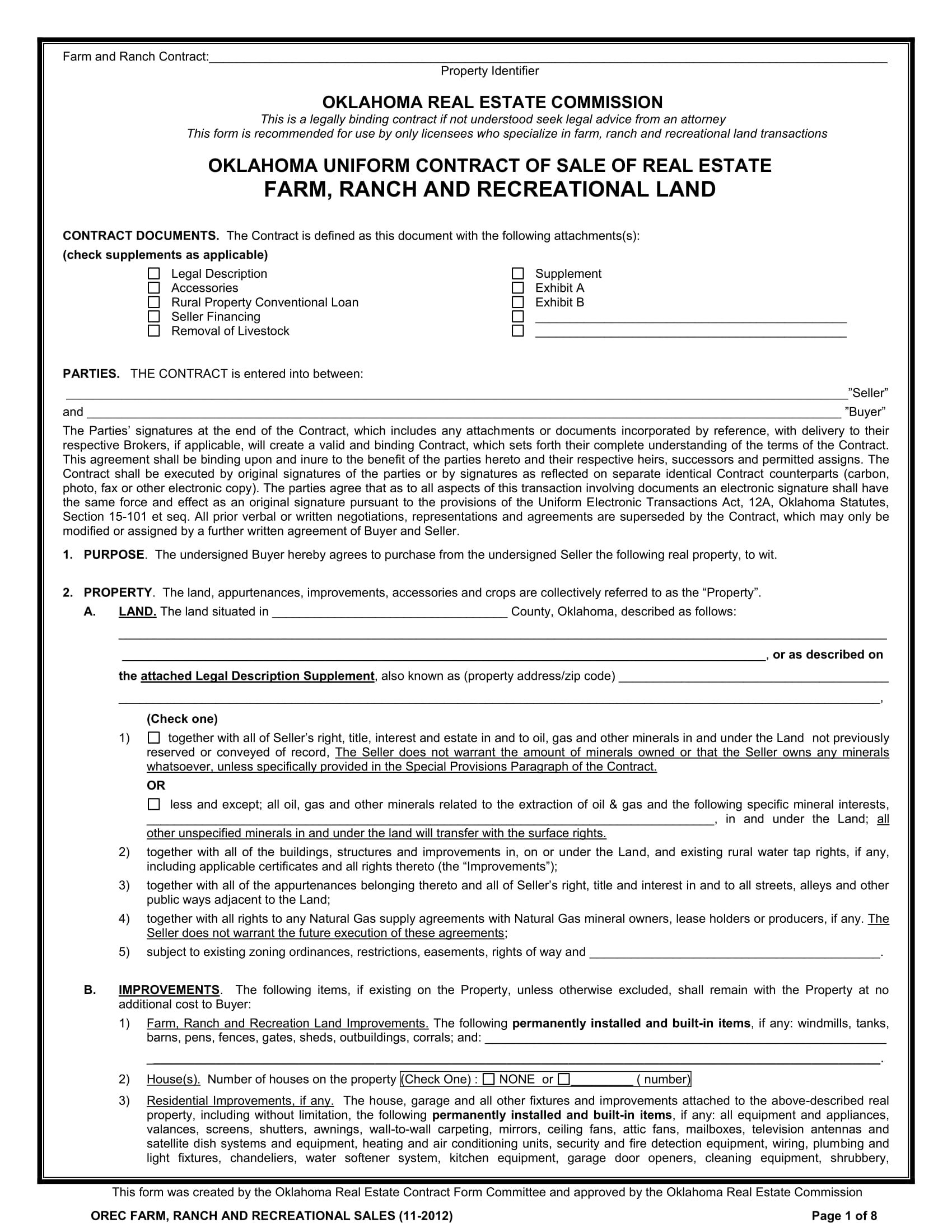

Farming Contract Template

Farm Equipment Write Off schedule c, box 25. Business use of your home (must use exclusively and regularly) car and. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. Simply by writing off the everyday. schedule c, box 25. examples of farming expenses that can be deducted: today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. You need internet to do your job! learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. The 2023 cap for the total amount written.

From www.pinterest.co.uk

Vending Machine Businesses for sale Lyons Wholesale Vending Small Farm Equipment Write Off today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. Simply by writing off the everyday. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. for 2019, farmers and small businesses could deduct up to $1,020.000. Farm Equipment Write Off.

From www.pinterest.com

Equipment Checkout Form Template Sign out sheet, List template, Sales Farm Equipment Write Off You need internet to do your job! Simply by writing off the everyday. for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. examples of farming expenses that can be deducted: using the section 179 deduction, you can write off the entire purchase price of qualifying. Farm Equipment Write Off.

From jigglar.com

How To Write A Real Estate Farming Letter (Step By Step) Farm Equipment Write Off examples of farming expenses that can be deducted: for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. Simply by writing off the everyday. You need. Farm Equipment Write Off.

From www.ebay.com

c1970s Fargo, North Dakota Farm Equipment Sales Patriotic Pen Myrl Farm Equipment Write Off “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. You need internet to do your job! learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. examples of farming expenses that can be deducted: today, farmers. Farm Equipment Write Off.

From www.sampletemplates.com

Sample Sign Out Sheet Template 8+ Free Documents Download in PDF Farm Equipment Write Off examples of farming expenses that can be deducted: learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. schedule c, box 25. Simply by writing off the everyday. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross. Farm Equipment Write Off.

From www.writtenoffpublishing.com

Services Written Off Farm Equipment Write Off You need internet to do your job! examples of farming expenses that can be deducted: “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. Business use of. Farm Equipment Write Off.

From www.pinterest.fr

7 Insanely Awesome WriteOffs that Solopreneurs Need to Know Farm Equipment Write Off for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. schedule c, box 25. You need internet to do your job! today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. learn all about section. Farm Equipment Write Off.

From www.hotixsexy.com

Receivable Write Off Form Fill Out And Sign Printable Pdf Template Farm Equipment Write Off You need internet to do your job! for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business property or equipment. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. today, farmers can deduct the full purchase price of a business asset. Farm Equipment Write Off.

From smallbiztrends.com

Here's How to Write Off Equipment and Capital Improvements Like a Pro Farm Equipment Write Off learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. The 2023 cap for the total amount written. Business use of your home (must use exclusively and regularly) car and. Simply by writing off the everyday. You need internet to do your job! “so with the section 179 deduction,. Farm Equipment Write Off.

From dandkmotorsports.com

Commercial Kitchen Inspection Checklist Dandk Organizer Farm Equipment Write Off Business use of your home (must use exclusively and regularly) car and. schedule c, box 25. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. Simply by writing off. Farm Equipment Write Off.

From www.signnow.com

Employee Equipment Responsibility Form PDF Complete with ease Farm Equipment Write Off The 2023 cap for the total amount written. schedule c, box 25. Business use of your home (must use exclusively and regularly) car and. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. today, farmers can deduct the full purchase price of a business asset like. Farm Equipment Write Off.

From retinue.com.au

Asset Write Off Eguide Retinue Accounting Farm Equipment Write Off “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. schedule c, box 25. You need internet to do your job! Simply by writing off the everyday.. Farm Equipment Write Off.

From www.sampletemplates.com

14+ Sample Equipment Sign Out Sheets Sample Templates Farm Equipment Write Off Simply by writing off the everyday. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. You need internet to do your job! Business use of your home (must use exclusively and regularly) car and. schedule c, box 25. learn all about section 179 which allows farms or businesses to. Farm Equipment Write Off.

From www.ebay.com

Farm Jack,48" Utility High Lift Farm Jack, 7000 lbs Capacity Ratcheting Farm Equipment Write Off using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the.. Farm Equipment Write Off.

From www.walmart.com

Remote Dump Trucks for Boys Age 47 Voice Control Car Car for Boys Age Farm Equipment Write Off The 2023 cap for the total amount written. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. Business use of your home (must use exclusively and regularly) car and. for 2019, farmers and small businesses could deduct up to $1,020.000 of the tax basis of certain business. Farm Equipment Write Off.

From www.ebay.com

c1970s Fargo, North Dakota Farm Equipment Sales Patriotic Pen Myrl Farm Equipment Write Off You need internet to do your job! “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. learn all about section 179 which allows farms or businesses to write off vehicles, or other heavy equipment and. for 2019, farmers and small businesses could deduct up to $1,020.000. Farm Equipment Write Off.

From corporatefinanceinstitute.com

PP&E (Property, Plant & Equipment) Overview, Formula, Examples Farm Equipment Write Off You need internet to do your job! Business use of your home (must use exclusively and regularly) car and. “so with the section 179 deduction, if you spend less than $1.08 million this year, you can write off the. examples of farming expenses that can be deducted: using the section 179 deduction, you can write off the. Farm Equipment Write Off.

From sitemate.com

Equipment Use Agreement template (for companies and employees) Farm Equipment Write Off You need internet to do your job! Simply by writing off the everyday. using the section 179 deduction, you can write off the entire purchase price of qualifying equipment up. today, farmers can deduct the full purchase price of a business asset like a tractor or combine from gross income. “so with the section 179 deduction, if. Farm Equipment Write Off.